Why Building a Recession-Proof Portfolio in 2026 Matters More Than Ever

Markets crash, but your wealth doesn’t have to — here’s your blueprint to stay steady and thrive through any storm.

It’s late 2025, and the financial world’s buzzing with unease. Tariff talks are heating up, the Fed’s rate path is still uncertain, and recession odds hover near 40%, according to J.P. Morgan and Bankrate. Yet whispers of an S&P 500 climb to 7,500 by mid-2026 — if AI momentum and policy align — keep optimism alive. Volatility is the new normal, and that’s okay. You don’t need a Wall Street badge to protect your capital. This guide distills timeless investing principles into a practical plan built to weather downturns, backed by fresh 2025 data on resilient sectors like healthcare and green energy. Whether you’re stacking your first $1,000 or managing a six-figure portfolio, this is your playbook for uncertain times. Let’s dive in.

Diversification: Your Portfolio’s Secret Weapon

Think of your portfolio as a ship in rough seas — one plank won’t keep it afloat, but a well-built hull will. Diversification spreads risk across assets that don’t move in sync, cushioning your downside when one part of the market cracks. In 2020’s COVID crash, portfolios with 40% bonds lost just 12%, while the S&P 500 sank 34%. Fast-forward to 2025: with geopolitics rattling markets, a mix of equities, fixed income, and low-correlation alternatives cuts drawdowns by up to 30%, according to Benzinga’s latest analysis. Looking to 2026, if recession odds play out (Bankrate pegs them at 39%), equities may cool — but bonds could rally 5–7% as yields retreat toward 3–3.5% on Fed cuts.

Build Your Core: ETFs and Defensive Sectors

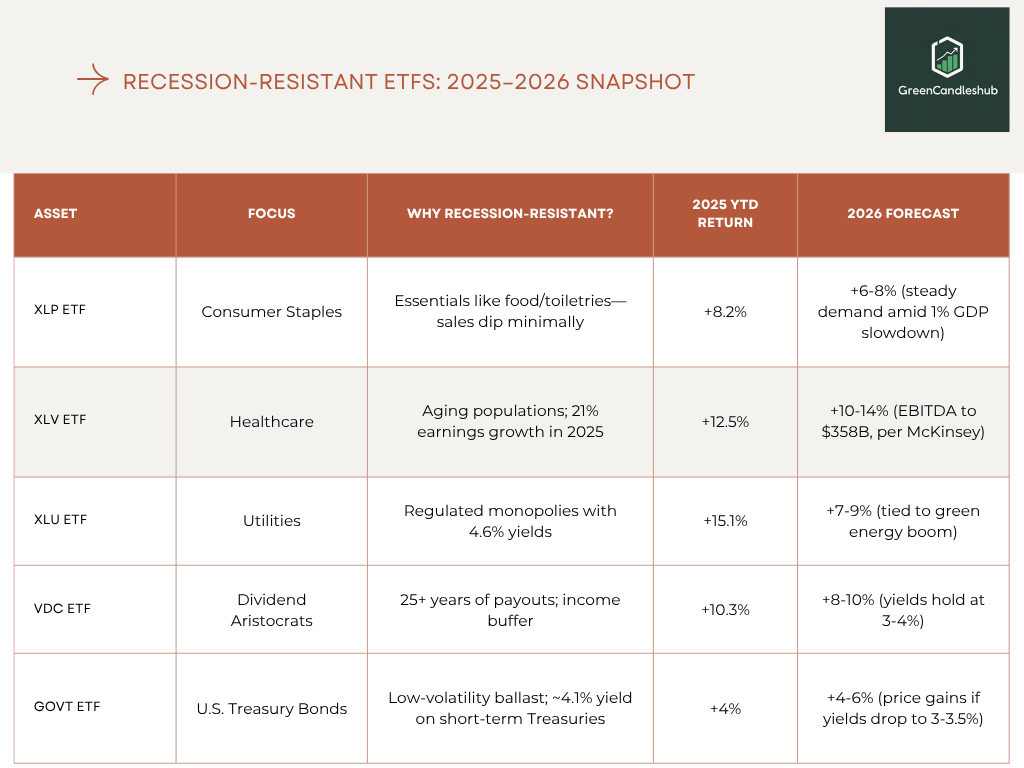

What belongs in the mix? Start with low-cost ETFs covering defensive sectors. Consumer staples — think food and toiletries — remain steady spenders’ favorites. The XLP ETF gained 8.2% in 2025, while healthcare (XLV) rose 12.5% amid a 21% earnings jump, per Tradejini. Utilities (XLU) added 15.1%, offering 4.6% yields, and dividend aristocrats like VDC delivered 10.3% returns. For 2026, expect similar outperformance: staples could hold 6–8% returns even if GDP slows to 1%, while healthcare targets 10–14% gains with EBITDA growth to $358B, per McKinsey.

Bonds are your ballast. The GOVT ETF is up 6% YTD, yielding roughly 4.1% on short-term Treasuries. If 2026 brings lower rates (J.P. Morgan projects 3.25–3.5% Fed funds), bond prices could climb another 4–6%. I-Bonds, locked at 4.03% through April 2026, remain a smart inflation hedge.

Dividend stocks still shine. Procter & Gamble (2.4% yield, 68-year payout streak) and Johnson & Johnson (3.1% yield) returned 7% in 2022’s bear market. In 2026, dividend aristocrats could post 8–10% total returns even if yields compress. And don’t overlook stablecoins. Dollar-pegged assets like USDC or USDT pay 4–5% through DeFi lending, holding firm in 2025’s $305B stablecoin market, per the IMF. Coinbase projects that figure could hit $500B by late 2026, with yields edging toward 6%. A 5–10% allocation here acts like digital cash — liquid, low-volatility, and inflation-beating.

Smart mix, simple math: A portfolio with 40–60% equities (like XLP, XLV, XLU, and VDC ETFs, plus stalwarts like Procter & Gamble and Johnson & Johnson), 30–40% bonds (think GOVT ETF or I-bonds), and 10% alternatives (gold or stablecoins like USDC) targets 7–9% returns in a 2026 soft-landing scenario or 4–6% in a mild recession—all at half the volatility of an all-stock setup. Free tools like Portfolio Visualizer, AnalyzerSuper, or CalcXML let you model these allocations and dial in correlations (stocks vs. bonds around 0.2 is the sweet spot) for a balanced, recession-ready plan.

2025’s Star Sectors: Healthcare and Green Energy Shine

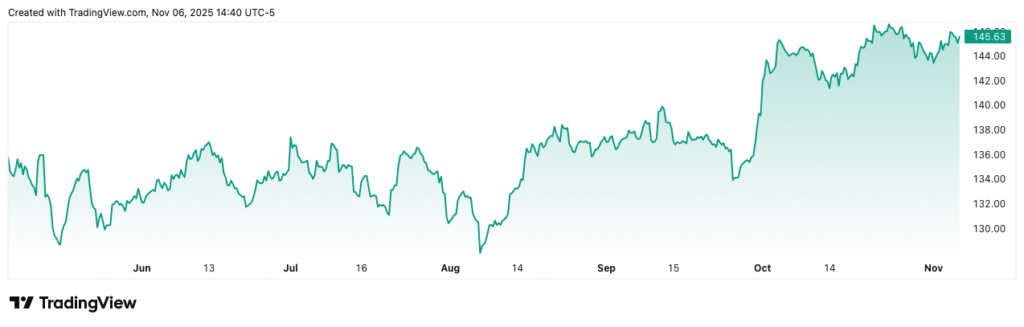

Recession-proofing isn’t just about playing defense — it’s about owning the sectors that thrive through turbulence. In 2025, healthcare and green energy did exactly that. Healthcare surged 21% in earnings this year, powered by biotech breakthroughs and aging demographics. Hospitals cut emissions 20% via AI-driven upgrades, according to the WHO’s April 2025 report. Defensive names like UnitedHealth and ETFs such as XLV remain strong havens: historically, healthcare dipped only 15% in recessions while the S&P fell 50%. McKinsey projects 15% EBITDA growth to $358 B by end-2026, with double-digit returns even under 2% GDP growth.

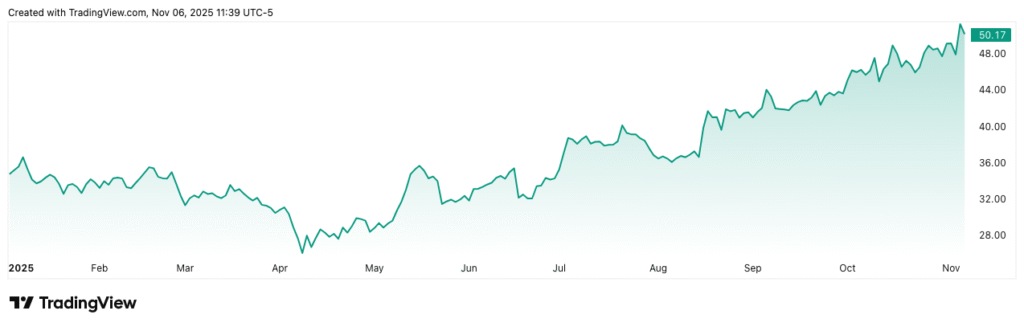

Green energy’s resilience is just as impressive. Renewables beat fossil fuels by 25% in 2025, backed by $1 trillion in green bonds (PA Future). The TAN ETF returned 18% YTD, aided by policy tailwinds and energy independence. Distributed solar reduced outage risks 30%, per Sustainable Energy for All. The IEA expects clean energy to reach 50% of global generation by 2026, overtaking coal. Deloitte forecasts 15–20% returns if domestic solar gets tariff support. These aren’t “niche ESG plays” — they’re structural growth engines. Even in a 2026 recession (26–40% odds, NY Fed/Statista), healthcare and renewables could outperform the S&P by 5–7%.

The Power of Steady Cash Flow

In every downturn, it’s the investors with reliable cash flow who sleep best. Dividends, bond coupons, and even the yield from stablecoins aren’t just income streams — they’re your portfolio’s heartbeat. They keep capital compounding quietly while the market argues with itself. In 2025, dividend payouts among S&P 500 companies hit a record $600 billion, according to Bloomberg, and history shows that reinvested dividends have accounted for more than half of long-term stock market returns.

That’s why “locking in income” isn’t about chasing yield; it’s about designing stability. When prices drop, those cash flows give you options — to reinvest at lower prices, rebalance without selling winners, or simply wait out volatility with confidence. It’s the difference between watching red candles and still seeing green in your account balance.

So while others focus on the next Fed move, focus on your inflows. Consistent dividends, modest bond yields, and 4–5% returns from stable assets create the breathing room that builds patience — and patience is what turns steady income into lasting wealth.

Dollar-Cost Averaging: Your Stress-Free Investing Hack

Trying to time the market is like guessing the next thunderstorm — unreliable at best. Vanguard’s 2025 study found lump-sum investing wins 68% of the time, but dollar-cost averaging (DCA) wins for sanity. It smooths out volatility and eliminates decision paralysis. In 2025, with the S&P’s volatility at 18%, DCA cut average entry costs 12%, per Forbes. Example: drip $500 monthly into VTI from January to June 2025 — you’d have gained 9%, beating a 7% lump-sum return thanks to April’s pullback. Study summary could be found here.

Setting up DCA is effortless. Use Vanguard, Fidelity, or Interactive Brokers to automate buys. Deploy fresh capital over 6–12 months to balance risk and reward, and track your plan with Personal Capital or Empower apps. For 2026, DCA is your emotional hedge: if the S&P rallies to 7,500, you’re fully invested; if it dips to 6,800, you’re buying bargains. It’s less about timing — more about time in the market. For more on behavioral discipline, revisit our patience investing manifesto.

Know Your Risk: Understand It Before It Understands You

Risk isn’t a vibe — it’s math with consequences. The calmer your portfolio behaves when markets panic, the better you sleep. To get there, start measuring what actually matters: volatility (how wildly your returns swing) and correlation (how much your assets move together). A good mix doesn’t eliminate risk; it makes sure your losers and winners don’t all show up at the same party.

Tools like AiOLux’s Value-at-Risk calculator translate those scary words into real numbers.

Here’s the difference: a simple 60/40 stock-bond mix usually wobbles about 10–12% a year, while an all-stock portfolio can lurch 18% or more. That means on a bad day, a $100K balanced portfolio might be down $2,000, versus $5,000 for a pure-equity gambler. Numbers like that make rebalancing feel a lot less optional.

You don’t need to crunch covariance formulas — just remember this rule of thumb: lower correlation = smoother ride.

If your Sharpe ratio (returns per unit of risk) is above 1, you’re doing great. Rebalance quarterly to keep those weights from drifting, and check how your portfolio might react to stress. Heading into 2026, run a quick “what-if” test: if the S&P slides to 6,800 — Traders Union’s bear case — your defensives should kick in, cushioning the fall.

Risk isn’t there to scare you; it’s there to guide you. Once you can measure it, you can manage it — and that’s what separates investors from speculators.

For more context on how diversification is evolving in the digital age, read our deep dive on Hong Kong’s crypto pivot and its global ripple effects.

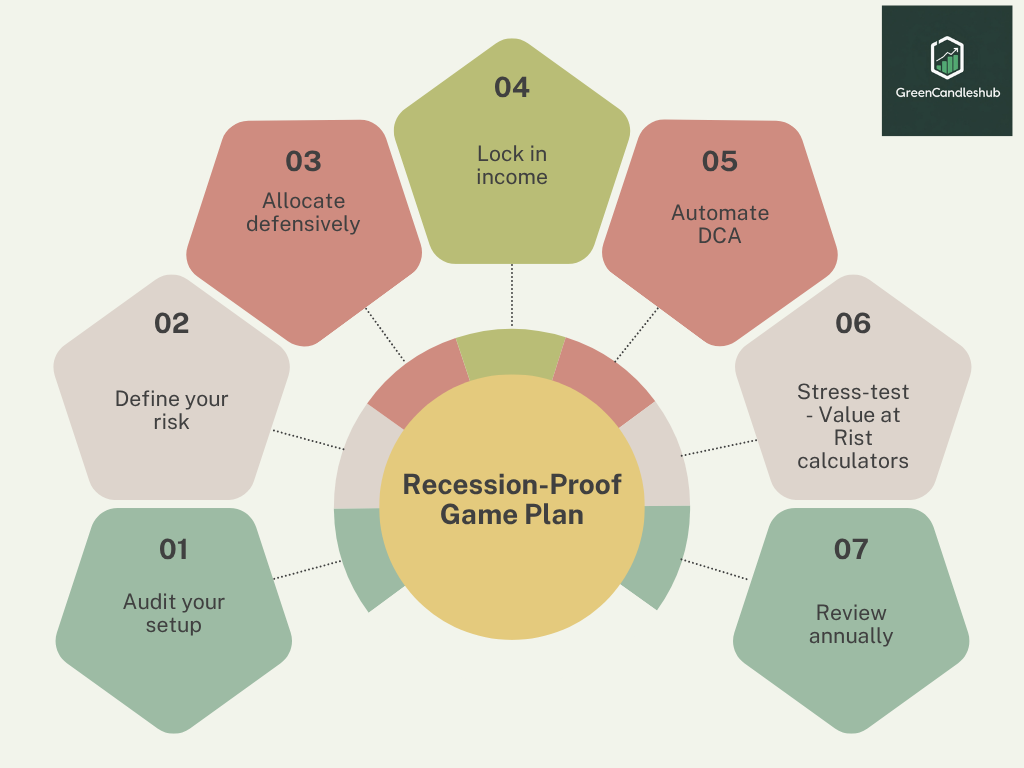

Your Recession-Proof Game Plan: 7 Steps to Start Now

Ready to build a recession-proof portfolio for 2025 and beyond? These seven steps are your practical roadmap for any market climate. From smart allocation to disciplined rebalancing and stress-testing, this playbook shows how to protect your downside, capture steady gains, and—most importantly—sleep well while others panic.

- Audit your setup: target 40–60% equities, 30–40% bonds, and 10% alternatives (stablecoins/gold)

- Define your risk: try Annuity.org’s risk quiz to calibrate exposure

- Allocate defensively: add 25% in staples or healthcare ETFs, 20% bonds, 10% green energy

- Lock in income: aim for 3–4% yield now, 5% + as rates ease in 2026

- Automate DCA: set fixed monthly buys in your core holdings

- Stress-test: use VaR (Value at Risk) tools; keep daily loss potential < 5%

- Review annually: update for new regulations and sector shifts (AI-healthcare, stablecoin audits)

Stay Steady, Win Big

Building a recession-proof portfolio isn’t about dodging every dip — it’s about staying positioned for the rebound that always follows. Markets move in cycles, but discipline compounds quietly beneath the noise. When you blend healthcare’s steady growth, green energy’s momentum, stablecoin liquidity, and the ballast of bonds, you’re not just hedging risk — you’re creating endurance.

It’s easy to get lost in forecasts and fear. But real wealth isn’t built on predictions — it’s built on consistency. The investors who win aren’t the fastest movers; they’re the ones who stick to their framework when the headlines turn red. One adjustment a week — a rebalance, an automated buy, a dividend reinvestment — is all it takes to keep your portfolio working while you sleep.

So breathe. You’ve got the blueprint. Keep your strategy calm, your allocations balanced, and your focus long-term. Because the next rally won’t reward the loudest trader — it’ll reward the most patient builder.

Got a portfolio you’d like reviewed? Drop it in the comments or reach out for a custom breakdown. Let’s keep those candles green — and your strategy steady. 🔥

This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice.

All economic and financial policy discussions are presented for scenario analysis and illustration only. Investing involves high risk, and you may lose capital.

Always conduct your own independent research and consult a qualified professional before making any financial decisions.