Why Markets Stay Calm as Trump’s New Tariff Plans Loom Over Global Trade

It sounded like the return of an old playbook: a former U.S. president pledging to raise tariffs, allies reacting cautiously, and traders bracing for another round of uncertainty. Yet despite Donald Trump’s recent comments about a new 10% tariff on Canadian goods, financial markets remain remarkably calm. The S&P 500 ended the week flat, the Nasdaq 100 even gained slightly, and the VIX volatility index stayed near year-to-date lows.

For many investors, this quiet reaction raises a question: have markets become numb to trade war headlines, or do they see something others don’t? Understanding this calm offers insight into how global capital now processes risk — and why volatility may be lower than intuition suggests.

The Familiar Cycle of Trade Tensions

The world has lived through a version of this story before. In 2018, tariff threats between the U.S. and China sparked a wave of global sell-offs and currency instability. Supply chains seized up, corporate executives issued warnings, and investors sought refuge in digital assets and gold. Back then, even rumors of a tariff list could shave hundreds of points off the Dow Jones Industrial Average.

Fast forward to 2025, and the context is very different. Inflation has cooled, the Federal Reserve is closer to its long-term rate target, and corporate earnings remain resilient. Investors have weathered multiple shocks — from pandemics to geopolitical crises — and are less prone to panic over policy rhetoric alone. This collective memory has built what many analysts now call “tariff fatigue.”

Markets Have Learned to Discount the Noise

Today’s market participants distinguish between talk and action. They know that political statements, especially during an election season, are often trial balloons. Until tariffs appear in formal trade policy or enforcement begins at the border, capital allocators see little reason to reposition portfolios.

Even algorithmic trading models, once hypersensitive to headlines, have evolved. Most major funds use natural-language filters that rank tariff news by credibility, scope, and probability of implementation. In short, traders are pricing probability, not fear.

At GreenCandlesHub, we’ve seen similar behavior in other macro events. When inflation data surprised to the upside earlier this year, stocks briefly dipped — then recovered within hours as markets recalibrated to the data rather than emotion. The same rational discipline now applies to trade talk.

Economic Resilience and the New Supply Chain Map

In the years since the original trade war, global companies have quietly rebuilt supply networks. Manufacturing that once relied heavily on China has diversified to Mexico, Vietnam, and Eastern Europe. U.S. importers learned to hedge currency risk, secure alternative suppliers, and adapt logistics far faster than before.

This means that when tariff chatter resurfaces, companies can adjust sourcing without massive shocks to earnings. The U.S. manufacturing PMI remains above 50, and inventories are leaner than in previous cycles. Economists view that as proof that supply chains have gained flexibility — a key reason the market’s reaction remains muted.

Currency and Commodity Markets Confirm the Calm

The currency market often acts as an early warning system for stress, yet the USD/CAD pair has barely budged since the latest announcement. It trades near 1.36, well within its 2025 range. That suggests investors see no immediate threat to trade flows or investment confidence between the two neighbors.

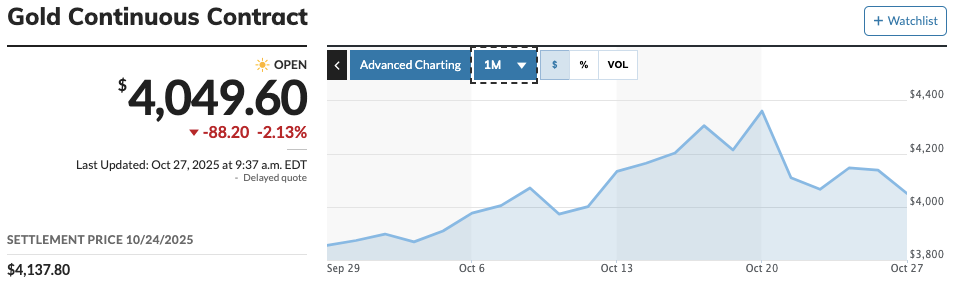

Gold and oil, the classic barometers of geopolitical anxiety, also show restraint. Gold futures rose slightly toward $2,480 per ounce — a modest hedge rather than a flight to safety — while WTI crude held above $82 per barrel, driven more by global demand expectations than politics.

Meanwhile, the CBOE Volatility Index (VIX) remains under 14, a level historically associated with steady equity inflows. As we discussed in our piece on Active ETFs and the Attention Economy, low volatility often encourages more algorithmic buying and options selling — behaviors that reinforce market stability even when headlines turn noisy.

Tariff Fatigue Meets Cooling Inflation

Inflation dynamics help explain why markets are not overreacting. With core CPI now below 3% year-on-year, investors have regained faith that the Federal Reserve can balance growth and price stability. Even if tariffs push up select import costs, the broader inflation trend appears contained. That reduces the odds of aggressive rate hikes — a much bigger driver of valuations than trade duties themselves.

Another key factor: corporate pricing power. Unlike in 2018, firms now possess sophisticated pricing algorithms that can offset incremental costs faster. Technology, logistics optimization, and AI-driven procurement have turned what was once an inflation accelerator into a manageable variable.

As one strategist told Reuters, “Markets no longer trade tariffs as systemic risk — they trade them as sector noise.”

The Psychology of Calm: Investors Have Rewired

The past decade has taught investors to separate signal from sentiment. The average portfolio manager now operates in a data-saturated environment where every rumor competes with earnings reports, macro releases, and Fed statements. Overreaction has a measurable cost, and those who resisted panic in 2019 or 2020 were rewarded.

Behavioral finance research supports this shift. Studies from the IMF and CFA Institute show that repeated exposure to policy uncertainty reduces its emotional impact on markets. In simple terms, traders adapt. This “desensitization” is visible in sentiment indexes and even retail trading patterns, where short-term spikes in volatility are quickly faded.

Sector Winners and Losers in a Tariff World

Still, calm doesn’t mean complacency. The potential redistribution of trade costs could create both risks and opportunities:

- Winners: U.S. manufacturing, domestic steel, and logistics firms stand to benefit if production reshoring gains momentum.

- Losers: Retailers and tech hardware importers dependent on cross-border supply chains may face margin pressure.

- Neutral players: Service sectors and digital-first businesses — which we covered in our ESG undervalued stocks feature — remain largely unaffected.

Analysts at major banks note that the tariff impact is now more about micro-economics than macro-shock. Investors can rotate exposure rather than exit markets entirely, which keeps volatility low.

Historical Perspective: Lessons From 2018–2020

During the original U.S.–China trade war, equity markets experienced multiple 5–10% drawdowns within months. But each correction was followed by recovery as companies adapted and policy negotiations advanced. The cumulative lesson: tariff threats alone rarely derail bull markets.

What mattered more was monetary policy. When the Fed signaled easing in 2019, equities rebounded sharply — a pattern repeating in 2025 as investors bet on rate cuts in early 2026. This relationship underscores that liquidity trumps tariffs in determining asset prices.

Global Reactions: Allies and Emerging Markets

Canada’s measured response also helped soothe markets. Ottawa emphasized dialogue over retaliation, aware that economic ties remain deeply intertwined. In Asia, the reaction was even more muted. Emerging markets like Vietnam and Indonesia — now beneficiaries of U.S. supply diversification — may actually gain from renewed U.S. protectionism.

Meanwhile, China’s policymakers have refrained from escalating rhetoric. Their focus is on stabilizing domestic growth and maintaining export competitiveness. As long as that remains the priority, trade disputes are unlikely to spiral into 2019-style stand-offs.

Risk Factors That Could Break the Calm

Despite composure, investors shouldn’t ignore key catalysts that could reintroduce volatility:

- Formal policy implementation: If the U.S. Trade Representative publishes official tariff schedules or Congress backs the proposal, algorithms will reprice risk immediately.

- Inflation surprise: Tariff-driven input costs could lift CPI again, forcing the Fed to tighten rather than ease.

- Retaliation risk: A response from Canada or China could revive fears of a global slowdown.

- Election dynamics: Trade policy may become a campaign tool, amplifying uncertainty in the months ahead.

For now, none of these scenarios have materialized — but investors know how quickly sentiment can shift once words turn into law.

Data Speaks Louder Than Headlines

Market behavior following the tariff comments highlights a broader truth: capital flows respond to data, not discourse. U.S. job growth, earnings revisions, and real wage trends have a far greater influence on risk appetite than any single policy statement.

That’s why traders continue to watch indicators like the ISM Manufacturing Index and personal consumption expenditures (PCE) inflation. As long as those remain stable, dips caused by political headlines are likely to be bought rather than sold.

Our recent coverage of Microsoft’s AI-driven earnings showed the same pattern: investors reward hard numbers and innovation, not speculation. The market’s discipline is its new defense mechanism.

What It Means for Investors

Short-term strategy: Stay data-driven. Monitor inflation prints, Fed communications, and sector earnings more closely than trade rhetoric. Consider using short-duration Treasury ETFs or hedged equity funds to buffer event risk.

Medium-term outlook: Tariffs could reshape relative performance across industries. Domestic industrials and infrastructure plays may gain, while import-heavy retail and tech could lag. Diversify exposure through ETFs tracking industrial and materials sectors.

Long-term positioning: Investors seeking stability may prefer dividend-paying blue chips or ESG-aligned funds with lower international dependency. As we argued in our analysis on dollar dominance, global capital continues to trust U.S. assets even amid policy turbulence.

Investor Takeaways

Despite fiery rhetoric, today’s markets show that investors have learned from the past. Supply chains are stronger, inflation is milder, and central banks remain credible. Tariff talk alone no longer triggers panic because the financial ecosystem has adapted to uncertainty.

As the year heads toward its final quarter, that calm may prove as important as any policy decision. Confidence — earned through years of shocks survived — is now the market’s most valuable asset.

At GreenCandlesHub, we believe this resilience marks a maturity phase for investors. Calm doesn’t mean complacent — it means informed, disciplined, and ready for whatever comes next.

This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice.

All economic and financial policy discussions are presented for scenario analysis and illustration only. Investing involves high risk, and you may lose capital.

Always conduct your own independent research and consult a qualified professional before making any financial decisions.