The AI Market’s Reality Check

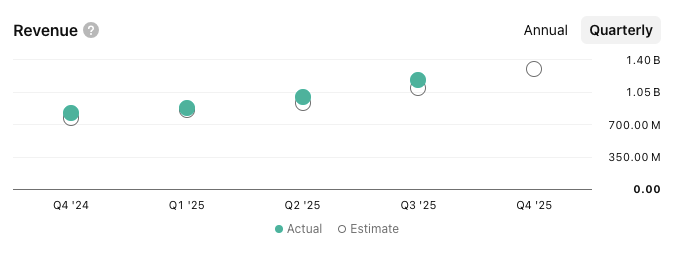

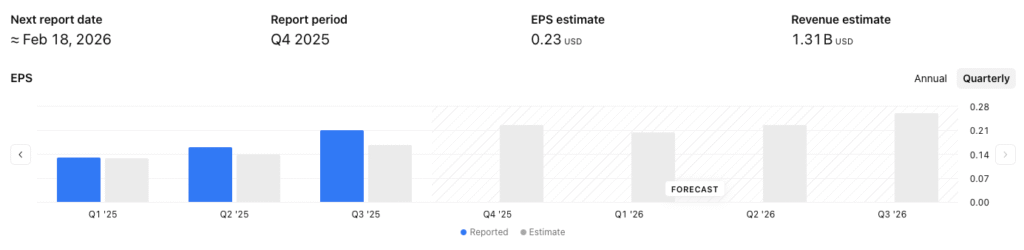

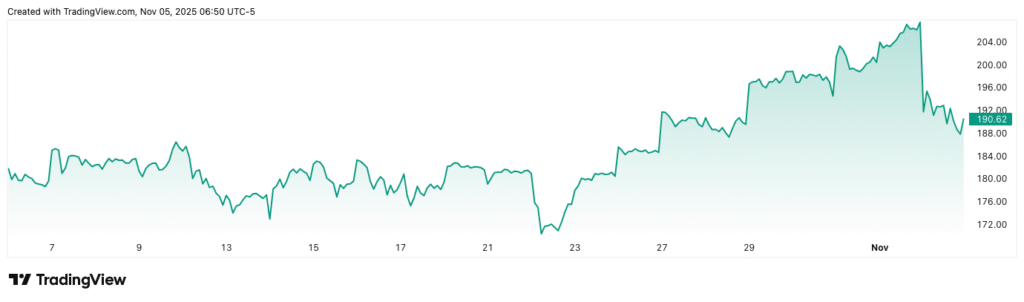

After a stellar run in 2025, Palantir Technologies (PLTR) faced a sharp 7% post-earnings drop, shaking confidence across global markets. The sell-off didn’t stop at U.S. tech—it rippled through Europe and Asia, fueling talk of an “AI correction.” Yet, at first glance, Palantir’s quarterly report gave investors little to fear. Revenue hit $1.18 billion, up 63% year over year and 18% quarter over quarter—beating Wall Street’s $1.09 billion forecast. Earnings per share came in at $0.21, well above the expected $0.17, representing a 110% YoY increase. By most measures, the numbers looked exceptional.

So why did the stock tumble? The answer lies not in performance but in valuation excess—and in how the market now weighs perfection against the faintest sign of slowing growth.

Why the Market Reacted So Harshly

Palantir’s Q3 showcased stellar fundamentals: a GAAP net profit of $476 million, a 40% net margin, and a “Rule of 40” score of 114%, a benchmark often used to gauge SaaS company health and balance between growth and profitability. Civilian sector revenue grew 29% quarter over quarter, while U.S. government contracts rose 14%. But even with such strength, investors balked at stretched expectations. The company’s forward P/E is roughly six times the industry average, while its price-to-sales ratio near 85 makes it one of the most expensive names in the S&P 500. At those levels, every small slowdown—like the shift from 63% to 61% forecast growth next quarter—can trigger an outsized correction.

In short, Palantir may have delivered perfect results, but the market had already priced in perfection and more. As one portfolio manager put it, “When expectations touch the stratosphere, gravity always wins.”

Smart Money Turns Cautious

Adding fuel to the sell-off, institutional sentiment has cooled sharply. While retail investors remain euphoric about Palantir’s AI promise, major funds are trimming exposure. Notably, Michael Burry’s Scion Asset Management disclosed a $912 million short position against Palantir earlier this quarter. The growing divide between retail optimism and institutional caution often marks a late-stage valuation stretch. Analysts now hover between neutral and negative outlooks, emphasizing that even a minor miss in future growth could prompt significant re-pricing.

Beyond Earnings: The Fundamentals Still Shine

None of this changes Palantir’s operational story. The company’s cash flow generation remains robust, with a free cash flow (FCF) margin of 22%, up from 18% last year, and a sticky base of long-term government and enterprise clients. Its global expansion, however, is showing signs of deceleration—international revenue growth trails domestic gains, suggesting that the U.S. market is nearing saturation. That imbalance might limit future scaling unless the company accelerates overseas adoption of Foundry and AIP.

Source: tradingview.com

How to Spot Undervalued Tech Stocks

Palantir’s story illustrates a broader truth: even world-class execution can’t outrun excessive valuation. Value investing principles—focusing on cash flow, growth-adjusted multiples, and durable moats—remain powerful tools for separating substance from sentiment.

1. Focus on Free Cash Flow

Revenue dazzles, but free cash flow reveals durability. Firms with FCF margins above 15% typically weather volatility better. Palantir’s 22% FCF margin is strong; by contrast, AMD’s remains around 12% as R&D investments rise. High FCF efficiency often signals long-term operational leverage—a key theme in our piece on patient investing.

2. Use PEG for Growth-Adjusted Value

Palantir trades at a forward P/E near 85, but its PEG ratio—P/E divided by growth—is about 1.2, implying that current pricing is at least somewhat supported by earnings momentum. Nvidia’s PEG near 2.0 tells a different story: much of its upside is already priced in. Historically, companies with PEG ratios under 1.5 have outperformed through cycles, offering a margin of safety when sentiment cools.

3. Look for Moats and Market Stickiness

Palantir’s core moat lies in its deeply integrated analytics ecosystems for governments and corporations. Those relationships are hard to displace and continue to underpin its premium pricing. By contrast, smaller AI startups without network effects or proprietary data often struggle once hype fades. The lesson applies broadly—prioritize IP, switching costs, and entrenched user bases when evaluating growth tech names.

4. Balance Sentiment With Fundamentals

Market psychology matters. Behavioral finance shows how overconfidence during bull runs often reverses sharply. Retail enthusiasm on X and Reddit boards contrasts with cooling institutional sentiment—a divergence worth watching. Investors who rely on quantitative strength and fundamental discipline can often find opportunity where emotion dominates.

5. Diversify and Manage Exposure

Even strong stories can turn volatile. Diversify across themes: AI analytics (Palantir), cybersecurity (CrowdStrike), and cloud data infrastructure (Snowflake). Keeping single-stock exposure between 5–10% ensures resilience against sentiment shocks. For context on navigating uncertain macro backdrops, revisit analysis of markets after the Fed pivot.

Is Palantir Still a Buy?

Palantir’s decline looks more like valuation gravity than a breakdown in fundamentals. The company continues to execute at an elite level—with strong growth, expanding margins, and a clear strategic moat. Yet its stock trades as if perfection is permanent, leaving almost no margin for error. For long-term investors, it may make sense to build exposure gradually, buying dips rather than chasing highs, while balancing positions with other quality tech names trading at more reasonable multiples.

Other Tech Names to Watch in November 2025

- UiPath (PATH): RPA automation leader with 20% FCF margin, PEG of 1.1, and improving monetization outside the U.S.

- CrowdStrike (CRWD): Cybersecurity giant growing 25% annually, with durable enterprise retention and strong cash flow.

- Snowflake (SNOW): Cloud data platform with 30% revenue growth and a PEG near 1.3, currently trading below Databricks-related hype.

Takeaway: Fundamentals Over FOMO

Palantir’s results were objectively strong, but the stock’s reaction shows that when expectations soar, even excellence can disappoint. The lesson is timeless: focus on fundamentals, not frenzy. Free cash flow, realistic growth, and defensible moats matter more than daily sentiment. As the AI sector matures, investors who separate quality from hype will own the next decade’s quiet compounders.

This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice.

All economic and financial policy discussions are presented for scenario analysis and illustration only. Investing involves high risk, and you may lose capital.

Always conduct your own independent research and consult a qualified professional before making any financial decisions.

Trump’s 50-Year Mortgage Plan: The Brutal Math Behind It