Patience Investing: The Forgotten Skill

In markets that move faster than attention spans, patience might be the last unfair advantage. It is not a virtue, but a skill — and one most investors have quietly unlearned.

The Cost of Impatience and Fast Trading in Modern Markets

Scroll through any trading app today and it feels more like social media than finance. Prices flicker, notifications buzz, and opinion polls masquerade as analysis. Investors refresh their screens with the urgency of someone waiting for a text that might change their life. The modern portfolio is rarely a long-term reflection of conviction; it’s a mirror of anxiety. In 2025, the ability to wait has become an act of rebellion.

We’ve written before at GreenCandleshub about the cost of information overload. More data doesn’t mean better outcomes. Algorithms fight for milliseconds of advantage, while human investors chase microtrends that fade faster than they load. Every whisper from the Federal Reserve, every AI-stock headline, every “urgent” crypto signal sparks the same reflex: do something. Yet history shows that the biggest fortunes have come not from motion, but from stillness.

The Discipline of Stillness: Long-Term Investing Strategies

Patience investing is often misunderstood as passivity. In reality, it’s one of the hardest disciplines in markets because it asks for conscious restraint. It’s not about doing nothing — it’s about doing less, but doing it better and for longer. Legendary investors like Warren Buffett and Charlie Munger built empires on this principle. Buffett’s Coca-Cola stake, bought in 1988, still sits on Berkshire Hathaway’s balance sheet today — a reminder that conviction compounds faster than reaction ever can.

Source: Saxo Bank savings calculator (saxo.com)

In contrast, the average holding period for a U.S. stock has fallen from over eight years in the 1950s to less than ten months today. That shift has created what might be called a “patience deficit.” Traders pay the cost invisibly: through taxes, transaction fees, emotional fatigue, and by missing the market’s best days. According to J.P. Morgan Asset Management, missing just the ten strongest days in the S&P 500 over the last two decades would have cut returns by more than half. The math is merciless — and it rewards endurance far more than brilliance.

The Psychology Behind Patience

Patience isn’t natural; it’s learned. The human brain evolved to react quickly, not to plan decades ahead. When markets fall, the body releases cortisol and adrenaline — chemicals meant to help us run, not reason. Loss aversion makes the pain of a loss feel twice as powerful as the joy of a gain. Overconfidence convinces us that one more trade can fix the problem. Recency bias blinds us to history and magnifies the last red candle on the chart.

Daniel Kahneman, the Nobel-winning psychologist, once described patience as “the willingness to trade immediate pleasure for delayed understanding.” In markets, that means resisting the temptation to outsmart randomness. It’s not exciting — but it’s effective. Study after study from Dalbar and Morningstar’s “Mind the Gap” report confirms that the average retail investor underperforms the very funds they invest in, simply because they don’t stay long enough to realize the returns.

When Waiting Works: Real Examples

Consider Amazon. Between 1999 and 2001, its stock price fell nearly 95 percent during the dot-com crash. Investors who panicked out saw their losses crystallize forever. Those who held — or bought again when the company’s fundamentals remained sound — eventually watched a $10,000 investment grow into millions. The difference was not genius. It was the willingness to hold through ridicule.

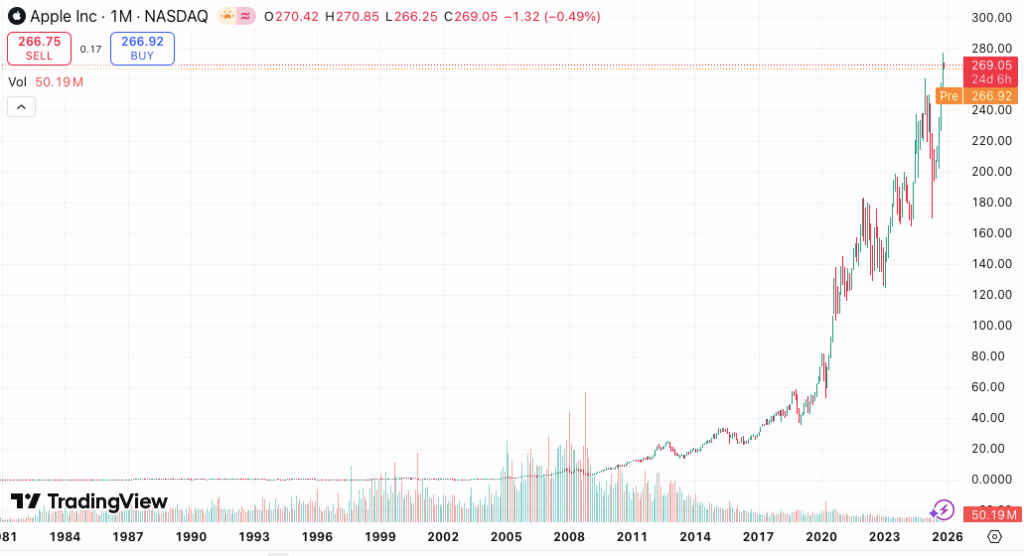

Or take Apple. In the early 2000s, it was still seen as a niche computer maker with little future beyond design loyalists. Long-term believers, including those who ignored Wall Street’s repeated “sell” ratings, saw compounding at its purest form. Between the launch of the iPod and the iPhone 15, Apple didn’t just change industries — it changed the psychology of waiting. Patience, in hindsight, looked prophetic.

Even in fixed income, patience matters. During the 1980s, U.S. Treasury investors endured double-digit yields and brutal volatility. Those who stayed invested through the rate-cutting cycle that followed saw once-boring bonds produce equity-like returns for years. Today, as yields rise again, the same lesson applies: what feels uncomfortable now often ages well.

Patience as Risk Management

Patience isn’t just about returns — it’s about survival. The 2025 investor operates in a market of constant motion, where leverage and automation amplify every twitch. The Bitcoin liquidation cascade of October 2025 illustrated this perfectly: tens of billions in positions were erased within hours as over-leveraged traders tried to time a dip. Meanwhile, spot holders who sized positions conservatively simply outlasted the panic. They weren’t smarter — they were still there when the noise stopped.

In traditional markets, the same principle holds. The Norwegian sovereign wealth fund — the world’s largest — invests with a thirty-year horizon. It doesn’t rush to front-run the news. It focuses on what it can control: allocation, diversification, and time. That’s the quiet power of patience: the ability to survive long enough for probability to favor you.

Avoid FOMO and Hype: The Humility to Wait for Value

Patience demands humility. The investor who demands constant novelty mistakes movement for mastery. Every few years, markets produce a new obsession: the AI boom, clean-energy euphoria, meme stocks, NFTs. Each cycle invites the same mistake — believing that excitement equals opportunity. But as our analysis of attention-driven ETFs showed, hype and profit rarely peak together. The earliest adopters get visibility; the patient get compounding.

Humility also means admitting that you will never buy the bottom or sell the top. Buffett’s famous line — “You can’t produce a baby in one month by getting nine women pregnant” — applies neatly to investing. Some processes simply take time, and the market won’t rush for you. A good business, like a good idea, matures on its own schedule.

Practical Framework for Long-Term Investing Discipline

Patience without structure turns into procrastination. The best investors don’t wait blindly; they design habits that make waiting productive. They revisit portfolios on a schedule — monthly or quarterly — instead of reacting to every price tick. They write down the reasons for owning each asset and what would invalidate that thesis. They prepare for boredom by diversifying across ideas that unfold at different speeds. These routines may sound ordinary, but they keep emotion from hijacking logic.

Energy investing offers a case study. The sector is infamous for its boom-bust cycles, yet disciplined investors who sized properly and stayed invested across them have seen exceptional long-term performance. As we discussed in our piece on tariff-driven volatility, the willingness to sit through geopolitical noise often separates short-term traders from true compounders.

Behavioral Finance and The Art of Slow Thinking

Slow thinking is not inaction; it’s reflection. It’s the pause that prevents regret. Nobel laureate Richard Thaler, in his studies on behavioral economics, noted that investors who check their portfolios less frequently tend to earn higher returns, precisely because they avoid reacting to every dip. A 2023 Vanguard study confirmed it: investors who logged in fewer than five times per month earned, on average, 1.5 percent more annually than those who logged in daily. The difference was emotional distance.

Technology tempts us to do the opposite. Trading platforms are gamified, designed to reward activity with dopamine. Even professional investors aren’t immune. During the 2020–2021 bull run, hedge-fund turnover hit record highs, yet the best-performing funds weren’t necessarily the busiest. They were the ones with the clearest process — and the longest patience.

The Long Arc of Compounding

Compounding, the quiet miracle of finance, only works with time. Albert Einstein allegedly called it the eighth wonder of the world — whether or not he actually said it, the math justifies the myth. A 7 percent annual return doubles capital roughly every ten years. Miss a few years because of panic selling, and you break the rhythm that makes the miracle possible.

This is why investors like Munger framed time as a friend, not an input. “The big money,” he said, “is not in the buying or the selling, but in the waiting.” That’s more than a quip; it’s a worldview. It assumes that volatility is not a signal but a toll — something you pay for the privilege of earning superior returns later.

Modern Patience: Lessons from 2025

So how does patience survive in a world of real-time everything? By reframing attention as capital. When everyone else trades on emotion, your edge becomes focus. Check your portfolio like you would check a long-term project — rarely, and with purpose. Measure progress in years, not weeks. Remember that not every tick requires a take.

We see this philosophy gaining ground again. A new generation of investors, shaped by volatility and humbled by hype, is rediscovering the calm logic of long horizons. The same mindset appears across asset classes — from pension funds extending duration in bonds, to crypto funds promoting “cold storage, warm patience.” Even the biggest institutions are admitting what retail investors forgot: compounding is a clock, not a contest.

The Cultural Shift from Trading to Compounding

Finance has absorbed the logic of social media. Everything must trend, everything must be now. Products advertise themselves like influencers, promising instant alpha. As we noted in our Active-ETF study, visibility often beats process in the short run. The antidote is cultural, not technological. We need to celebrate patience again — to treat holding a good position for five years as a greater achievement than flipping ten in a week.

Language matters, too. Instead of asking “What’s your price target?” we could ask “What’s your time horizon?” Instead of “What’s next?” we could ask “What endures?” These small shifts remind us that markets reward foresight, not frenzy.

Conclusion: Your Time Horizon is Your Greatest Edge

The next bull market will not belong to those who refreshed the most screens. It will belong to those who refused to donate their attention. Information will keep multiplying, urgency will keep selling, and impatience will keep paying the bill. The rest of us can buy something cheaper and more enduring: time.

This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice.

All economic and financial policy discussions are presented for scenario analysis and illustration only. Investing involves high risk, and you may lose capital.

Always conduct your own independent research and consult a qualified professional before making any financial decisions.