Meta Platforms entered the third quarter of 2025 like a champion who knows the scorecard is in their favor and still insists on training for a tougher fight. The company delivered one of its strongest revenue prints in years, lifted by healthy advertising demand and a visible uplift in engagement across Facebook, Instagram, and WhatsApp from AI-driven ranking and creation tools. Then, in the same breath, it reminded investors that the future doesn’t come cheap. A large, non-cash tax charge torqued the headline profit lower, and management doubled down on guidance for a heavier investment cycle. The market flinched. The business didn’t.

That tension—between robust, cash-generating present and capital-intensive, AI-first future—defines Meta’s story right now. It’s a two-speed narrative that invites misreads if you only watch the first line of an earnings press release or the first tick in after-hours trading. Under the surface, the mechanics are clearer: advertising is doing the heavy lifting, engagement is rising, free cash flow remains meaningful, and the company is laying steel for an infrastructure footprint that aims to convert attention into durable advantage. Whether that advantage monetizes on the timetable that public markets prefer is the crux of the investment debate.

What the Quarter Actually Said

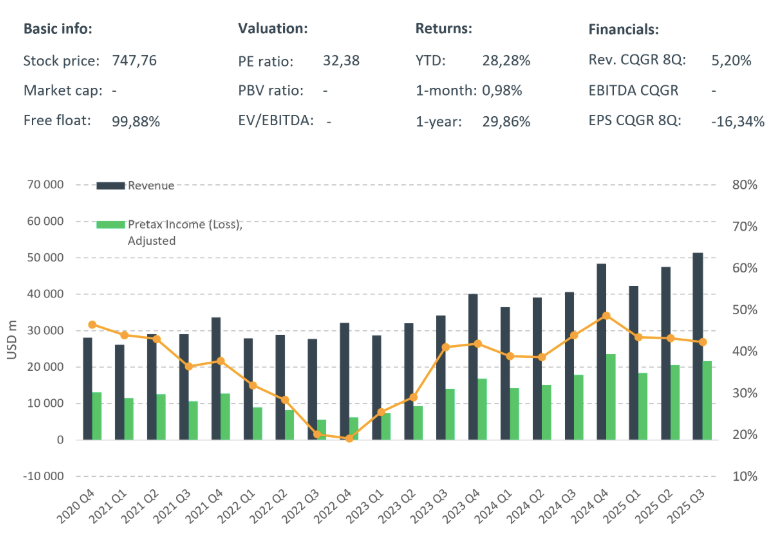

The headline was simple: revenue of roughly $51.24 billion, up about 26% year on year. Within that figure, Meta’s ad engine showed the kind of balance that comfort investors: impressions increased by roughly 14% and the average price per ad climbed close to 10%. The user base proved the scale story is not exhausted; the company’s “family” of daily active people reached about 3.54 billion, an increase of approximately 8% versus last year. On an operating basis, Meta generated in the area of $20.5 billion of operating income, good for a near-40% operating margin, modestly below the year-ago period as spend ticked up with the investment cycle.

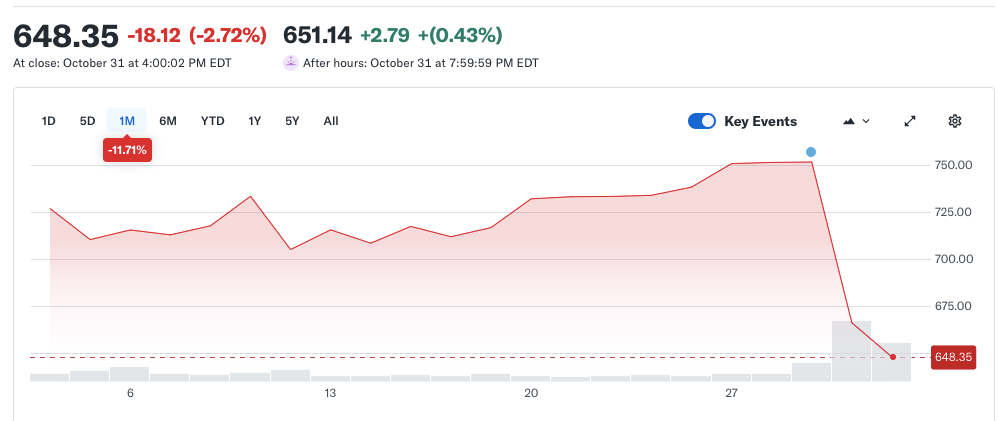

Then came the accounting foghorn. A roughly $15.9 billion non-cash tax expense, tied to changes in the U.S. tax code, lifted the effective tax rate into the eighties and pulled reported net income down to about $2.7 billion, with GAAP EPS near $1.05. Meta didn’t leave investors guessing about the underlying power of the franchise: excluding that one-time item, management indicated net income would have been approximately $18.6 billion, with EPS near $7.25. Free cash flow for the quarter remained solid at roughly $10.6 billion, even as the company pressed on with a heavier capital budget. The market absorbed the split personality of those numbers and decided, at least for a day, to focus on the price tag of the future rather than the strength of the present. The stock traded lower by high single digits after the print.

Guidance did not attempt to soothe at all costs. For the fourth quarter, management outlined revenue in a band of roughly $56–59 billion, consistent with the pace of growth already visible in the fundamentals. The message was stability in demand rather than heroics. Where the tone sharpened was on the spending side: executives reiterated that 2025 capex would land around $70–72 billion and that 2026 would be “significantly higher”, a direct reflection of a faster build in AI data centers, networking, and AI-specialist headcount. In other words, the operating machine is humming; the construction crews are not going home.

For the primary source detail, Meta’s official results release offers the quarter’s figures, language around the U.S. tax impact, and the latest capex posture.

The Shape of the Engine: Ads, Attention, and AI-Accelerants

Digital advertising is still the gravity well. Meta’s ability to grow both ad volume and pricing in the same quarter speaks to three reinforcing dynamics. First, the company’s recommendation systems—now infused with larger, more capable models—continue to improve the relevance of content in feeds and short-form video. Better relevance is time spent; time spent is inventory; inventory is revenue. Second, the tools available to advertisers are getting sharper. Whether you’re a global brand pushing a tent-pole launch or a small business chasing cart completions, Meta’s conversion machinery is steadily more precise. Third, the apps are a federation of attention that few competitors can match. Instagram reels pull you in; WhatsApp keeps you connected; Facebook groups organize your hobbies and hyper-local communities. Each surface creates context; together they create habit.

AI has become the quiet co-author of all of this. The company’s feed ranking and ad delivery already leaned on machine learning; the difference in the 2025 stack is scale and speed. Training modern recommender systems and large language models at the cadence demanded by billions of users is not a side project; it is a capital program. The capex budget is the outward sign of an inward truth: Meta is shifting from software that uses compute to a platform strategy that owns compute, at least to the extent necessary to keep latency low, iteration fast, and breakthroughs in-house. From a distance that can read like an arms race. From inside the product, it feels like a smoother explore page, a more intuitive AI assistant, and ads that waste less of a marketer’s money.

Cost Gravity and the Case for Building Moats the Hard Way

The choice to spend at this scale is not an indulgence; it’s a wager on architectural advantage. In a world where models are commoditizing at the edges and access to third-party foundation models is increasingly straightforward, the scarce resources migrate up the stack: proprietary data to fine-tune on; distribution to deploy into; compute to train with at a cadence fast enough to matter. Meta has the first two in unusual abundance. The third is what it is buying, most obviously in the denominator of free cash flow and in the growing depreciation line that will follow.

There is a vivid analog in our broader coverage: when we looked at the Microsoft + OpenAI axis and Azure’s acceleration earlier this autumn, the underlying lesson was not that one model “won,” but that owning distribution and owning the upgrade cycle of your own infrastructure can bend unit economics in your favor over time. For readers who want that angle in depth, our longform on Redmond’s AI moat is here: Microsoft AI Earnings 2025: Azure & OpenAI Moat. Meta is making a version of the same calculation, tailored to social surfaces rather than developer platforms: if inference lives closer to your products, the products feel better, and if training is in your hands, your iteration loop can be faster than the market’s patience.

Of course, moats built this way are expensive on the way up. Operating margins compress when the concrete is still wet. That is what you saw in the third quarter: a 40% operating margin that remains elite, and yet a few points lower than last year as depreciation and opex lean in the wrong direction for headline optics. Long-horizon investors will watch a different set of deltas. Does engagement hold or expand as AI-infused features roll out? Do advertisers see higher return on ad spend in a way that translates into budget wins ahead of the broader cycle? Do messaging-anchored commerce flows grow in WhatsApp and Instagram in markets where chat is the default storefront? Those answers become margin stories later, when the construction cranes come down and the new building starts charging rent.

Where the Optionality Lives

The center of gravity will remain advertising for the foreseeable future, but some of Meta’s most interesting tail risk—good and bad—sits just to the side of ads. Short-form video has already gone from defensive response to contributor. The next ring out is messaging-native commerce and business communication. The idea is not new: turn the thread you’re already in into the place an issue is resolved, a product discovered, a transaction closed. In regions where WhatsApp is the public square and the phone book, that’s simply formalizing behavior that already exists. If Meta cracks this at scale in a way that feels native, it would attach a second monetization engine to markets where ad budgets are thinner or less organized than in the United States.

Then there’s the hardware and immersion story. Reality Labs has been a long, sometimes bruising investment. Its line item is not the star of any quarter’s earnings deck. Yet it remains the proving ground for what it would look like to bring the assistant—and the creation tools and the lightweight compute needed to run them—closer to your line of sight. The near-term vector here is not “metaverse or bust,” but the quieter march of smart glasses, better cameras, more ambient capture, and voice-forward interfaces that make AI a background capability rather than a destination app. The revenue model for that world will not be simply, or perhaps even primarily, hardware margin. It will be time. And time, for Meta, converts to revenue in more than one way.

Regulation, Competition, and the Price of Scale

It would be incomplete to describe Meta’s current moment without acknowledging the policy weather. Size is an advantage in distribution and in compute purchase orders; it is a liability in regulatory attention. The company continues to operate under privacy regimes in Europe that evolve faster than product cycles, faces scrutiny in the United States on youth protection and platform design, and must plan with the possibility—however distant—of structural remedies in mind. None of this is brand new; what is new is the degree to which AI itself becomes part of the policy conversation, from model transparency to targeted advertising’s future shape in a world where content and copy are increasingly machine-assisted.

Competition remains real, not in abstract market share but at the level where user attention fragments and recombines. TikTok’s gravity on short-form video has forced everyone to raise their game. YouTube remains the most formidable rival for advertisers who want video storytelling and searches that smell like intent. Messaging is a crowded field by country and by demographic. What Meta brings is federation: the ability to move a user from a reel to a creator’s profile to a storefront to a chat thread without leaving its own borders. If users keep making those trips, the ad budget follows. If not, the company can still grow with the market, but the premium on the multiple gets harder to hold.

Interpreting the Selloff Without Over-Learning It

The post-earnings slide told a familiar, almost ritual story for mega-cap tech. Investors absorbed a quarter with eye-catching top-line growth, muted GAAP profit because of a non-economic charge, and a spending plan that was both clear and larger than the market would prefer. In a world that has spent the past two years learning to fade AI wish-casting and to demand line-of-sight to monetization, the initial reaction was logical: prove it. The stronger response is to ask what, precisely, the company needs to prove, and how you would know if it’s doing so.

On our read, the proof points are sequential and observable. Engagement should remain firm even as feeds and formats change around AI-assisted creation. Advertiser ROI should improve at the margin in ways that manifest in budget retention through macro wobble, not just in good quarters. Messaging-native commerce should throw off enough case studies to move from ambition to habit in at least a handful of core geographies. And the capex arc should crest, then bend toward a more “normal” cadence as the most build-heavy years pass, with depreciation recognized against products that are obviously better than the ones they replaced. This is not a one-quarter narrative. It is, however, one you can track without being a romantic about the technology.

Why the Macro Backdrop Matters Less Than Tone—Until It Matters More

There is a macro overlay here that we’ve been writing about all autumn. Markets have spent months trading central-bank tone at least as intensely as they’ve traded data. That typically boosts long-duration, growth-heavy assets when the language turns friendlier and tightens the screws when a phrase lands wrong. In our feature on policy signaling and market psychology—How Markets React After a Fed Pivot—we argued that the first move is often relief and the second is gravity. Meta’s quarter arrived in a market already toggling between those moods. If policy remains on a glide path and credit stays open, an ad platform with improving ROI can hold its altitude. If the path gets bumpy, budgets compress first at the edges and then in the middle. It is not that the macro doesn’t matter; it’s that Meta’s micro improved enough this year to give it a cushion.

The Investment Case in Human Language

Strip away the acronyms and you’re left with a company that does two things unusually well. It captures attention at staggering scale. And it turns a growing portion of that attention into money more efficiently than almost any other business on earth. The question the stock asks you, today, is whether you believe that same company can spend tens of billions of dollars to ensure it continues to do both of those things in a world where algorithms curate more of our time and where the line between tool and content keeps blurring.

If your instinct is yes, then the volatility around a heavy build-out is less a warning than an admission price. The path is noisy, but the destination looks like a platform that owns its own destiny in the AI era and can offer advertisers and users products that feel, simply, better than last year’s. If your instinct is no, then the quarter’s selloff was not a blip; it was a first draft of a re-rating in which spending chases an ever-moving objective and margins spend more time compressing than expanding. Both views are coherent. The data, so far this year, lean toward the optimistic one: users up, impressions up, pricing up, revenue up.

What We’ll Be Watching Next

We’ll keep a close eye on the fourth-quarter revenue range and how it lines up with seasonal dynamics and broader macro sentiment. Advertiser commentary around return on spend will be equally important as AI-driven tools become a larger part of Meta’s ad ecosystem. Another area to watch is messaging-based commerce — whether it can move from investor-deck promise to visible user habit across markets well beyond India and Brazil. Finally, the shape of capital expenditures and subsequent depreciation will reveal how the 2026 investment cycle truly unfolds. And we will watch the friction line where regulators, parents, creators, and brands argue over the design of platforms that now braid together human creativity and machine assistance in ways that were theoretical two years ago and daily reality today.

That last point matters for investors because it is uniquely binary. If the company gets the design choices mostly right, the reward is sustained engagement and a smoother runway for monetization. If it gets them wrong, the cost is not just fines or headlines; it is time. And time, in this business, is the price of everything.

A Final Word on Patience

Meta’s quarter was not subtle. It said, clearly, that the business is strong, that accounting noise can still swamp a clean operating story on a given day, and that the company prefers to be judged on a multi-year arc rather than on a single-quarter margin line. You do not have to agree with every line item in the capex budget to understand the strategy. You only have to decide whether the payoff logic resonates: better models create better feeds; better feeds create more time; more time creates more monetization surfaces; more surfaces justify infrastructure you control rather than rent. The rest is execution.

We will keep score on that execution through 2026. For now, the balance of evidence says Meta remains a powerhouse in transition, with a core that throws off cash, a plan that soaks up capital, and a realistic chance that the two meet in the middle, not just in an earnings slide, but in products that make the case for themselves when you open the app.

This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice.

All economic and financial policy discussions are presented for scenario analysis and illustration only. Investing involves high risk, and you may lose capital.

Always conduct your own independent research and consult a qualified professional before making any financial decisions.