| Green Candle Meaning: What It Tells You About Market Moves |

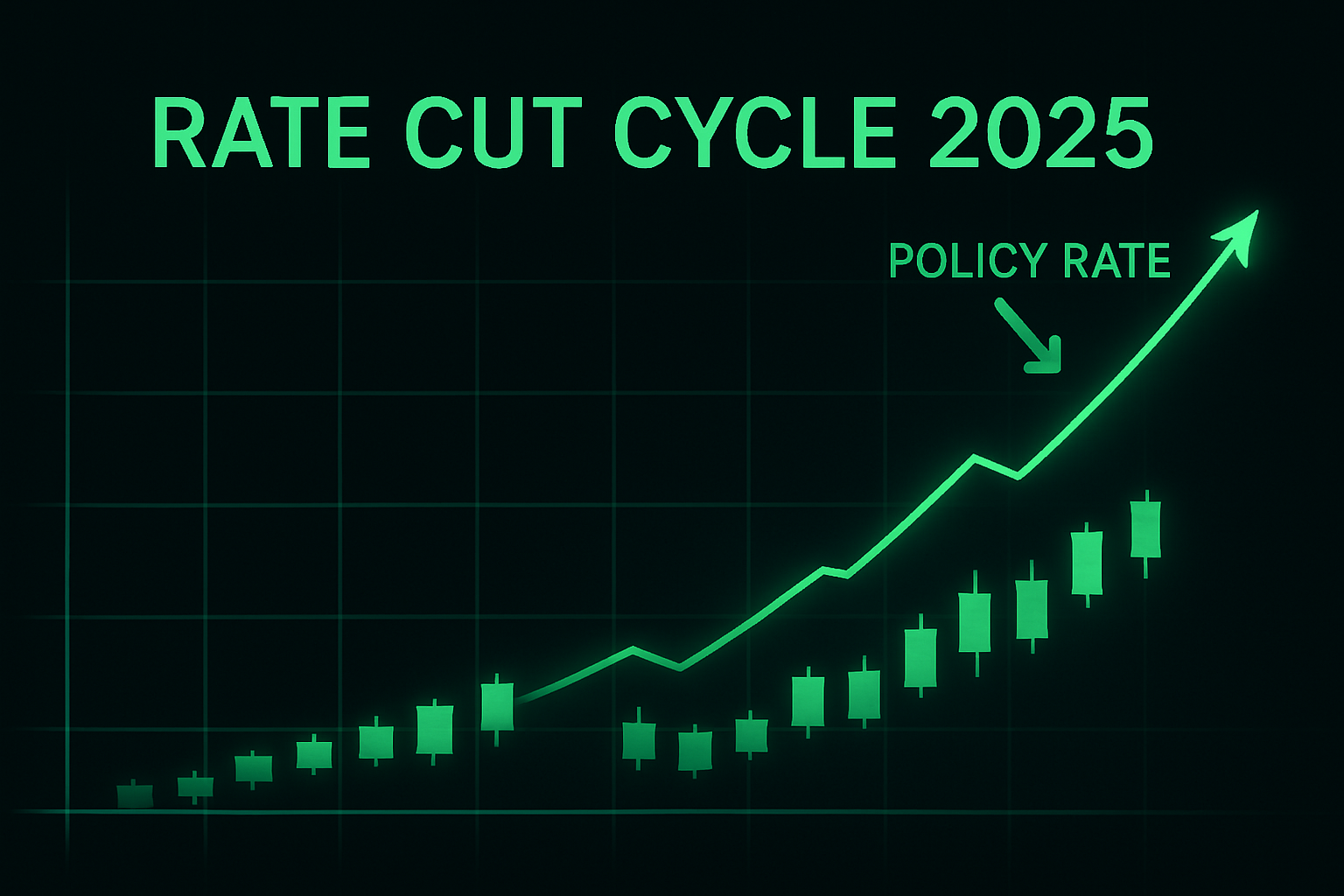

The Green Candle: What It Means and Why It Matters to Every Investor

Green and red candles are the market’s native language. In this guide, you’ll learn the green candle meaning, how to read candlestick charts, why green candles matter, and how to avoid common mistakes.

What Is a Green Candle?

A green candle on a candlestick chart means the closing price is higher than the opening price for a given time period—an hour, a day, a week, etc. In short, buyers pushed price higher.

- Green = Bullish movement (buyers in control)

- Red = Bearish movement (sellers in control)

Example: if a stock opens at $100 and closes at $110, the candle prints green. The body shows the distance between open and close; the “wicks” (shadows) show the extremes of price during the session.

Quick takeaway: A green candle reflects upward momentum and bullish sentiment.

Why Does a Green Candle Matter?

Green candles provide fast insight into market behavior:

- Market sentiment: A green candle shows optimism and demand.

- Momentum: A series of green candles can suggest a strengthening trend.

- Timing: Traders often use green candles to refine entries in bullish phases.

The Psychology Behind Green Candles

Every candle captures human emotions. When a chart prints green:

- Buyers feel confident about further upside.

- Sellers hesitate, waiting for better prices.

- FOMO (fear of missing out) can amplify the move as late buyers rush in.

However, exuberance can overheat markets. A rapid run of large green candles without pullbacks may signal fragility rather than strength.

How Investors Can Use Green Candles

For Day Traders

- Watch for green candles near support as potential entry cues.

- Confirm with volume and context (trend, levels, catalysts).

For Swing Traders

- Use clusters of green candles to confirm short-term bullish trends.

- Combine with patterns (e.g., bullish engulfing, hammer) and moving averages.

For Long-Term Investors

- Treat green candles as context, not standalone buy signals.

- Prioritize fundamentals; use candles to read crowd behavior.

Common Mistakes to Avoid

- Overweighting a single candle: Context across multiple candles and timeframes matters.

- Ignoring volume: A green candle on thin volume is less meaningful than one on strong participation.

- Forgetting fundamentals: Technicals complement (not replace) business quality, valuation, and catalysts.

Green vs. Red Candles: The Key Difference

- Green Candle: Close > Open (bullish).

- Red Candle: Close < Open (bearish).

Together they narrate each session’s tug-of-war. Learning to “read” sequences of candles helps investors anticipate potential price paths.

FAQs About Green Candles

- What does a green candle mean in stock trading?

- A green candle means the asset closed higher than it opened—typically a bullish sign indicating upward momentum.

- Is a green candle always bullish?

- Not always. It’s generally bullish, but significance depends on context—trend direction, volume, nearby levels, and broader market conditions.

- What’s the difference between a green candle and a red candle?

- Green indicates buyers pushed price higher (close > open); red indicates sellers pushed price lower (close < open).

At GreenCandlesHub, we believe knowledge is the real wealth. Follow for more on trading psychology, strategies, and market fundamentals.